Europe: Which stadiums generate the most revenue in Europe?

source: UEFA; author: Miguel Ciołczyk Garcia

A UEFA report published some time ago analyses the state of football clubs in Europe and their financial performance in 2022 and 2023. It did not lack stadium statistics. How did European arenas perform?

A UEFA report published some time ago analyses the state of football clubs in Europe and their financial performance in 2022 and 2023. It did not lack stadium statistics. How did European arenas perform?

Advertisement

What does stadium Europe look like?

According to UEFA report The European Club Finance and Investment Landscape, 12 projects - construction and modernisations - were completed in 2023, indicating little change. This is partly due to municipalities owning the majority of stadiums, which to some extent ties the hands of clubs when it comes to upgrading their arenas or building new ones.

The biggest changes have taken place in Spain, France and Italy, with three completed projects each in 2023.The federation's figures show that the overwhelming majority of countries, 28, have built at least one stadium in the last 10 years.

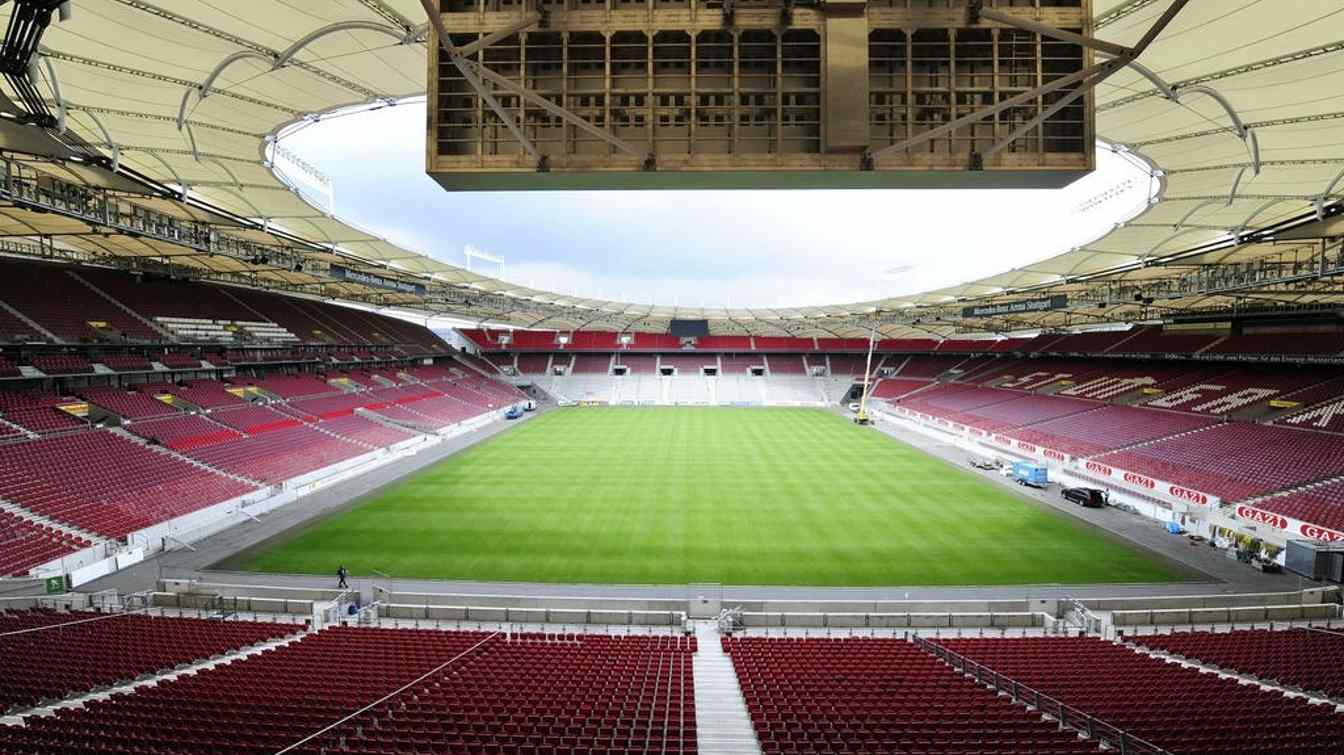

The biggest catalyst for the expansion of sports infrastructure are reportedly international tournaments. Examples cited by FIFA include the expansion of the MHPArena for EURO 2024 or the construction of the new Casement Park for EURO 2028. However, as the authors of the report note, the high level of tournament hosts’ infrastructure development makes more new stadiums unnecessary. The situation is different in Turkey, which has built many stadiums in recent years in the hope of hosting the EURO.

© Mercedes-Benz Arena | MHPArena

© Mercedes-Benz Arena | MHPArena

Which country has the largest “capacity”?

The report also provides data on the capacity of arenas belonging to teams from Europe playing at the highest level of domestic competitions. Germany has the highest average with 41 100 seats, followed by England (39 400), Russia (37 600) and Italy (37 100). In total, Europe's top league arenas have a capacity of around 11,700,000 seats.

Who pays the most for stadiums?

In 2022, clubs invested €1.1 billion in fixed assets, primarily stadiums. This is 26% less than in 2019, the pre-pandemic period, but 25% more than in 2021. The English spent by far the most, for which the construction of Everton Stadium is primarily responsible. After the English, the French were second in spending on fixed assets, while the Germans, Spaniards and Italians allocated only 4% of revenues.

This is not the only statement in which the English lead the way. Between 2018 and 2022, Premier League clubs invested €2.5bn in fixed assets, while the other Big 5

countries - Spain, Germany, Italy and France - invested just €2.1bn. Incoming figures for 2023 suggest that projects such as Nou Camp Nou will improve these results.

© Mister Drone UK | Construction of Everton Stadium

© Mister Drone UK | Construction of Everton Stadium

Who owns Europe's arenas?

64% of stadiums in Europe are owned by public authorities. 88 teams (12%) own the arenas as their direct property and 62 (8%) as part of companies or as club owner facilities. The remaining 16% of stadiums are owned by other entities. Only 18% of European clubs therefore own the facilities as property or have them on a long-term lease.

Arenas owned by public authorities, most often cities, can be problematic because of the conflicts of interest that often arise, for example in covering the costs of modernisation, expansion of facilities or responsibility for the facility. A very prominent example of this is the conflict between the Paris administration and PSG, which may result in the club moving out of Parc des Princes.

© Zakarie Faibis (CC BY-SA 4.0) | Parc des Princes

© Zakarie Faibis (CC BY-SA 4.0) | Parc des Princes

Which stadium makes the most money from tickets?

It will come as no surprise to anyone that matchdays account for most of the revenue generated by sports venues. In 2022, Europe's top clubs collected €3.1 billion from this. This represents an increase in 2021, but, as with stadium spending, the figures are lower than before the pandemic.

The highest figures were cranked out, again, by the English. The clubs from there earned on average €44m on tickets in 2022, twice the average result of the Spanish teams - €21.6m. Here are the Big 5

results from ticket sales:

| Country | Total revenue (in €m) | Average (in €m) | Mediana (in €m) |

|---|---|---|---|

| England | 894 | 44,7 | 25,5 |

| Spain | 432 | 21,6 | 6,1 |

| France | 355 | 17,7 | 6,8 |

| Germany | 301 | 16,7 | 11,9 |

| Italy | 218 | 10,9 | 5,6 |

Early figures for 2023 show a 32% increase, caused by the softening of pandemic restrictions and record attendances in the 2022/23 season, with 209 million fans watching matches at the highest levels of the game from the stands. This was the statistic of the top-earning stadiums on matchday in 2023:

| Pos. | Club | Stadium | Ticket revenue (millions of €) |

Revenue per game (millions of €) |

|---|---|---|---|---|

| 1. | FC Barcelona | Spotify Camp Nou | 190 | 7,6 |

| 2. | PSG | Parc des Princes | 153 | 6,6 |

| 3. | Tottenham | Tottenham Hotspur Stadium | 135 | 5,6 |

| 4. | Real Madryt | Estadio Santiago Bernabéu | 134 | 4,8 |

| 5. | Manchester United | Old Trafford | 128 | 3,8 |

| 6. | Bayern Monachium | Allianz Arena | 121 | 5,2 |

| 7. | Arsenal Londyn | Emirates Stadium | 118 | 4,9 |

| 8. | Liverpool | Anfield | 92 | 3,7 |

| 9. | Manchester City | Etihad Stadium | 84 | 2,5 |

| 10. | AC Milan | Stadio Giuseppe Meazza | 79 | 3,0 |

Untapped potential

One way for sports venues to generate revenue is through a sponsorship deal that includes, for example, stadium naming rights. However, this is not as widespread in Europe as in the United States, with only 18% of top league stadiums taking the name from naming-rights investors.

In Italy, 80% of teams play in venues with traditional names rather than commercial names. The situation is similar in France (78%), England (75%) or Spain (70%). In opposition is Germany, where only 4 stadiums do not take their name from a sponsor. Austria has the highest percentage, with 83% of the arenas there bearing a name chosen by the companies.

The conclusions of the report are quite clear. The performance of European arenas is returning to pre-pandemic levels. Clubs are increasing ticket revenues significantly and upgrading their arenas to optimise revenue and cover operating costs, but the creation of new arenas is no longer as frequent as it once was, although smaller and larger projects will continue to emerge.

Advertisement

StadiumDB

StadiumDB